Believe in contrarian investment strategies, avoid chasing market sentiment, and believe in independence...

Publication date :2023-11-24

Author:Nord Testing

Views :

Author:Nord Testing

Views :

“Before investing in private equity funds, in addition to clarifying whether they are qualified investors, investors also need to fill out a risk questionnaire.

Understand your own risk tolerance, cooperate with the fundraising agency in investor suitability management, and finally purchase fund products or services that match you. "

What is investor suitability management? Investor suitability management means that the fundraising agency, in the process of selling fund products or services, combines with investors Based on the risk tolerance of the fund, investors will be given matching suggestions based on the appropriateness matching principle, so as to achieve the purpose of allowing investors to purchase matching fund products or services.

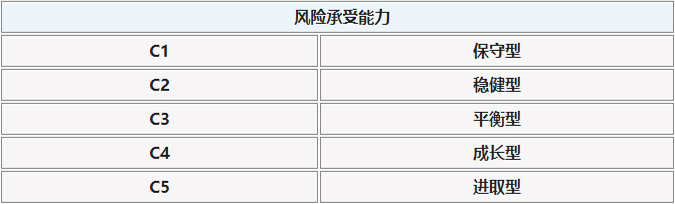

1. Assessment of investor risk tolerance & nbsp; The level of ability is divided into at least five types from low to high: C1, C2, C3, C4, and C5.

Take the following example: The lower the score, the lower the investor's risk tolerance. Investors should consider fund products or services with a sound style when making investment decisions.

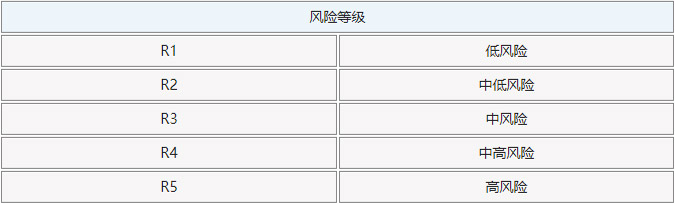

2. Risk level classification of products or services   ; The corresponding relationship between the assessment score and the risk level of the fund product, in order from low to high risk, divides the product or service into at least five levels: R1, R2, R3, R4, and R5.

3. Investor suitability matching principle The fundraising agency should establish the following suitability matching principles based on the risk tolerance of investors and the risk level of fund products or services:

Create a global testing and certification brand to help companies go global.

Create a global testing and certification brand to help companies go global.